Some Economic Reforms

Statement of Principles

The concept of “moral good” is defined only in the context of a single individual’s judgement of the best available means of assuring the survival and flourishing of their own genes, over the long haul. And to be clear, these sorts of moral judgements are made with a view to “all things considered” and “in the long run”. Each individual, in the pursuit of the moral good, pursues what they judge to be in the best long-term interests of their genes — even if they are not aware of that consideration at the time. In the absence of clear immediate considerations, most moral judgements are made in an environment lacking of much evidence as to the available alternatives and their likely consequences. The best moral judgements, therefore, are made using learned “rules-of-thumb” that have a history of working more often than not.

Each individual brings to the Struggle of Life their own unique combination of native talents, learned skills, and chosen goals. Each brings their own unique appreciation of their needs and wants. Each individual therefore values things and relationships to the extent that they contribute to the achievement of their goals, the satisfaction of their needs and wants. What one person values, another might not. What I value highly, you might have enough of. What you value highly, I might have enough of. If we each exchange something we value less for something we value more, we both profit from the exchange.

Voluntary exchange is the only way that individuals can interact with each other while pursuing their judgement of the moral good. Voluntary exchange is the only way that individuals can interact with each other while pursuing what they each value. In voluntary exchange, all parties to the exchange gain. In any other form of interaction, one individual will lose. In any other form of interaction, coercion is employed to extort value from (at least) one party to the interaction.

Economic relations between individuals should therefore be limited to voluntary exchanges. The employment of coercion or fraud in any form should be delegitimized. The involvement of government should be restricted to

1. The enforcement of contracts;

2. The defense of individuals against coercion from enemies foreign and domestic;

3. The regulation of “externalities” where market forces cannot operate.

Therefore, as a general principle, the government should not be permitted to enact any legislation that infringes on any individual’s freedom to engage in a voluntary exchange of values. The proper role of the government is to protect the individual’s right to free and voluntary trade from coercion and fraud.

Progressive versus Regressive Taxation Impacts

A “Progressive” tax structure is one where the rate of taxation increases as the taxable amount increases. A “Regressive” tax structure is one where the proportion of tax paid decreases as the taxable amount increases.

The moral rationale behind a progressive tax structure is that those who have the higher taxable incomes are reaping proportionally greater benefits from whatever is being funded by the tax, have more to lose if those benefits were to disappear, and therefore “should” pay proportionally more. This rationale is based on the presumptions that

1. the taxes paid ought to be proportionate to the benefits received.

2. those with the larger incomes, and presumably greater assets, are benefiting proportionally more from social and economic stability, and the rule of law, maintained by the government;

3. their larger incomes and greater assets are made possible by the sustainment of such a conducive environment;

4. the opportunities that were created to earn such large incomes and amass such great wealth are a direct consequence of such a conducive environment; and

5. these people would thus loose proportionately more than citizens less well off should such a rewarding environment cease to exist.

One politically still popular rationale for progressive taxes, that history has proven to be totally bankrupt, is the philosophical position that the wealth of the wealthiest “ought” to be expropriated by the government and redistributed to the poorest in the society. This argument is based on the socialist ethical principle that the needs of the many morally justify the forcible expropriation of the wealth of the few – i.e. that needing something is more ethically worthy than earning something. The collapse of the Communist and Socialist economies has vividly demonstrated that this ethical reasoning is critically flawed.

The rationale behind a regressive tax structure is operational simplicity. Openly regressive tax structures are almost always either a flat percentage of the taxable amount, or a fixed single amount. The fixed single amount is often especially attractive politically, since it can be marketed fairly easily on an egalitarian “per capita user-fee” basis. The most common current examples of regressive taxes are sales and value-added taxes (single percentage of taxable amount), payroll taxes (fixed amount per employee), unemployment insurance, and social security taxes (fixed percentage up to a specified limit, and a flat amount there after). There is quite likely an additional “hidden” rationale behind the kinds of regressive taxes that have been so widely implemented. They usually impact hardest those in the society with the least political leverage. And because that population is also the largest numerically, the regressive taxes reap larger total dollar amounts than would be politically acceptable via a progressive structure.

The current popularity of a “Flat Tax” approach to income tax reform is based on its supposed simplicity when compared with the overly-complex status-quo. All the “fairness” arguments that are presented are founded on the dubious suggestion that however regressive a flat-tax approach would be, it would be more progressive than the current system that lets many of the wealthy off “scot-free”. At least that is the public claim. As in all political campaign pronouncements, the reality is quite a bit different.

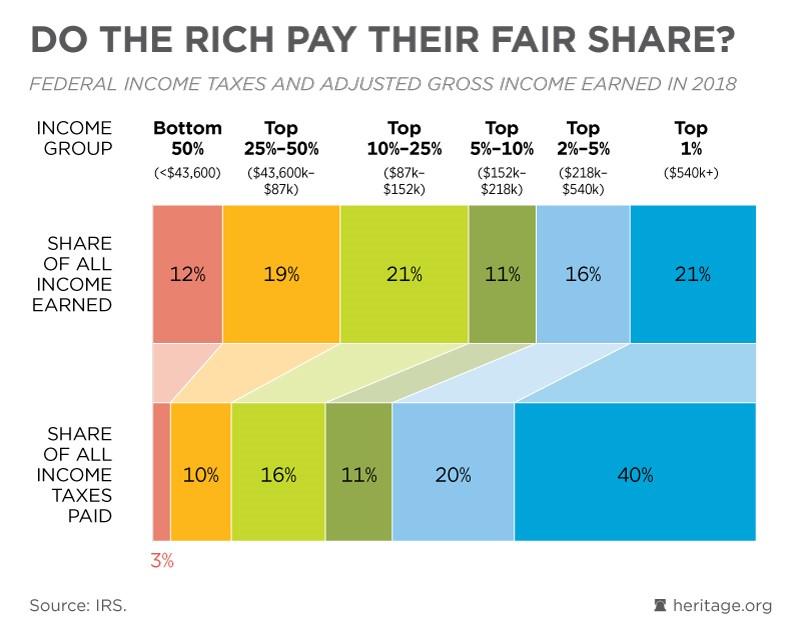

Based on research done by The Heritage Foundation into the data provided by the IRS, the top 1% of all U.S. Income Tax Returns for 2018 reported 21% of all taxable income, but paid 40% of all US Federal Income taxes.

Research done by the Institute on Taxation and Economic Policy into the U.S. 2019 data, the top 1% of income earners earned 20.9% of all reported taxable income, but paid 24.1% of all taxes — based on estimated combined Federal, State, and Local taxes.

Even in those relatively rare cases where the wealthy have managed to pay little or no “Income Tax”, they are still subject to the same “User-Fees” and “Sales-Taxes” as the rest of us. And since the wealthy have, by definition, more income to dispose of in the first place, they inevitably wind up paying a greater total amount of such taxes (per capita) that do the non-wealthy. Thus, while the reality is that for some of the wealthy the taxation system is not as progressive as might have been intended, it is not true that they pay no taxes at all. A 5% sales tax on a $2 million yacht pays considerably more than the same sales tax on a $2 bottle of water. Even on the several hundred bottles of water a less wealthy person might purchase over their lives.

Moreover, given the inherent complexities of defining what “income” would be subject to such a flat tax, it is questionable whether a significant portion of the plethora of existing loop-holes would actually be closed. Even the proponents of the flat-tax approach recognize that it would be regressive and that regressive taxes are somehow less desirable than progressive ones. Although few, even among the experts, acknowledge the readily available evidence that supports that attitude.

Personal Income Taxes

Personal Income Tax brackets need to be completely re-configured. In addition, all payroll taxes (such as Canada Pension and Unemployment Insurance taxes, Social Security Payroll taxes, and other such more-or-less flat taxes) that are currently imposed most heavily on the lower income brackets should be eliminated. Each year, statistics from the previous year should be employed to re-align the tax-bracket boundaries.

Taxable Family Unit — All individual income should be included in the calculation of taxable income, with no exceptions or deductions. Provisions for “deductions” for spouses and other dependants could be managed by calculating the tax rate on a “per-capita taxable income” basis for the family unit. All income for the members of a “taxable family unit” would be treated together. And all members of a “taxable family unit” would have to maintain a common residence as their principal residence. This would have the added advantage of providing a stronger economic incentive for all families to incorporate more “dependants” into their families — by birthing more children, adopting children, or including a more extended family. And it would correct the current tax-created strong disincentive for an extended family to function as a single economic unit. All of which are socially desirable outcomes. By comparison, the currently allowed deductions for spouses and dependent children or other family dependants are laughably inadequate – to the point of being strong economic incentives to smaller families and disowning relatives. (For example, it currently makes strong economic sense for a girl to be an unemployed un-wed mother, than to marry and live with an employed husband.) By defining a “Taxable Family Unit” in terms of shared principal residence, rather than family kinship, it would remove any discrimination against same-sex couples, or other non-traditional “marriages”. And by encouraging the amalgamation of unrelated individuals into a shared principal residence, it would open up greater opportunities for family-like mutual support in times of need.

Negative Income Tax / Guaranteed Minimum Income — At the present time, there exist a plethora of government programs designed to help the needy. Each such program develops its own bureaucracy, its own population of benefit recipients, and its own population of people interested in taking unintended advantage of it. (Supporters of subsidized housing programs, for example, include landlords who profit from supplying sub-standard housing to tenants who cannot complain.) Because of the tendency of any aid program to attract such a constituency of interested supporters, most government aid programs wind up providing more benefits to people it was not intended to, than people it was intended to help. All such programs should be terminated. In their place should be enacted a “negative income tax” or “guaranteed minimum income”.

Those who would help the destitute have some idea what minimum level of income (per person or per family) is necessary to provide the bare necessities of life. Rather than have a multitude of special programs to help different groups of people in need, the income tax system should be used to help these people. If the individual’s (or the taxable family unit’s) “net taxable income” is less than the “basic standard deduction”, then the government should refund the difference to the taxpayer. Just as it currently works if the taxes owed are less than the taxes you have paid throughout the year.

If even half the monies currently earmarked to “aid the poor” are re-directed to fund the negative income tax, the poor will be much better off than now. All of the monies now going to fund the various bureaucracies will be recovered and put to its originally intended use. And all of the negative side effects of the various “aid to the poor” programs will be eliminated. (Subsidized housing programs, for example, create instant slums by concentrating in one place a number of people with little interest or incentive in taking care of their place of residence.)

The Negative Income Tax / Guaranteed Minimum Income proposal has been studied extensively in the United States as well as many other countries, and been found eminently workable. All sorts of provisions can be inserted into the specification of “basic standard deduction” to allow for aid to people with disabilities, aid to the aged, and so forth. And provisions can be made for the payment of “advances” in the event that some misfortune should befall the victim before the end of the tax year. Making the rate of negative tax proportional to whatever income is earned would eliminate the disincentive to work. Currently, a number of aid programs have limits to the amount the recipient is allowed to earn before the benefits are cut off. Which amounts both to a huge disincentive to find productive employment, and a huge incentive to cheating in various forms.

For more discussion of this, see the essay on Universal Basic Income.

Recommended Tax Brackets — Based on the information available on the proportion of taxes paid by various segments of the population, it is therefore recommended that there should be seven tax brackets. The tax authorities in each country have the necessary data from the tax returns that they process to figure out where the boundaries should be (in terms of taxable incomes) between the five quintiles. The lowest 20% should probably pay no income taxes at all — but that is a political decision that can be made once the system is corrected. And of course, the highest 20% should pay the highest rate of tax. The additional two tax brackets beyond the five quintile, would separate out the highest 10% and the highest 1% for an even greater tax rate. For example, this chart from Heritage.org shows the basic idea —

The IRS in the United States, and Revenue Canada in Canada, and their equivalents in other countries, have the necessary data to annually adjust the boundaries of the tax brackets, and even the marginal tax rates in each bracket, so that the requisite number of tax returns fall into each category in the next tax year and the stipulated income from the tax system is achieved. All the Legislature has to do is mandate how much tax income is required. By removing the details from the grubby grasping fingers of the legislators, we can remove a whole host of opportunities for special interests to manipulate things.

Capital Gains Tax — A “capital gain” is the difference between the (adjusted) purchase cost of an asset, and the net proceeds of the sale of that asset. For the purposes of personal income taxation, the purchase cost of the asset should be adjusted by the inflation rate since the date of purchase – so that purchase and sale are expressed in same-year dollars. The adjusted purchase cost of a productive asset should be depreciated by the assumed rate at which the asset wears out (following standard rules for operational accounting of depreciation). The resulting “taxable capital gain” should then be treated as part of “Income” for the purposes of personal income taxes.

Updating How We Deal with Corporate Entities

De-Personalizing Corporations — Under British Common Law, a corporation has a distinct legal identity from its shareholders. But it does not have all the legal status of a “person”. Although various court decisions over the years have chipped away at the differences. Under American law, however, the US Supreme Court in 1886 ruled that the 14th Constitutional Amendment (equal protection of the laws) applies to corporations — thus making corporations and other legal fictions “persons” under the law. This needs to change. Companies and corporations, partnerships and other legal entities, are not “persons” by any reasonable definition. These legal creations should not have the same rights and privileges as “persons”. Most particularly, there is no reason for these legal creations to have the same rights of free speech, free assembly, equal protection, religious practice, and so forth. Elimination this foolish fiction would —

- Prevent legal creations from contributing to political campaigns, or from purchasing any advertising that might influence political campaigns. (No inherent right of free speech!) Individual employees, partners, and shareholders have all the rights due to a “person”. But legal creations do not.

- Allow different criteria to be developed when a legal creation is sued by or is suing a real individual person. For example, a news outlet being sued for libel or defamation would be held to a different standard than an individual being sued for libel or defamation. (No inherent right for equal protection under the laws!)

- Prevent legal creations from ducking social responsibility on the basis of religious beliefs — corporations and so forth not being such as to have any beliefs. (No inherent right to religious freedom!) Unless specifically created to pursue a political or religious agenda (in which case employees and shareholders must be aware of the purpose of the legal creation), legal creations have no business pursuing political or religious agendas.

“Own-able Corporation” Rule — There are few, if any constraints on how one corporation or other legal creation can “own” another. It is thus a frequent occurrence that one corporation can own portions of other corporations in a network of confusing inter-ownerships where it is almost impossible to figure out who owns what. This possibility makes it difficult (if not impossible) for a prospective shareholder to know just what is in fact owned by the corporation whose shares are being examined. Moreover, the frequently exercised possibility of chains of less-than-complete ownership, can render the minority shareholders of subsidiary companies almost completely without recourse.

Consider the situation where Company A owns 51% of company B, which in turn owns 51% of Company C. Then the minority shareholders of Company C are left with little or no influence over the affairs of Company A, when it is Company A who determines the economic future of the shares of Company C.

Therefore, for the purposes of public trading in corporation ownership instruments (stock or bonds or similar stuff), an “Own-able Corporation” should be defined legally to consist of the amalgamation into a single ownership entity of all companies (and related legal entities) where one company owns more than 50% of another legal entity’s outstanding debt and equity ownership instruments. (The details need refinement, and may have to include the concept of a less than 50% but still a controlling interest, and would have to deal with complex networks of ownership.) The basic idea would be to make “ownership” more commensurate with “management responsibility”.

The rule would prevent a giant corporation from fooling the stock-owning public into buying “ownership” of small pieces of something managed at a more amalgamated level. And it would prevent the “real” owners of assets from hiding behind a confusing network of inter-ownerships. Whenever one company acquired enough ownership of another to trigger this rule, all of the ownership instruments in the bought company would have to be swapped for instruments in the buying company. None of this operating a business as a division of a subsidiary of a holding company run by a shell corporation foolishness.

Corporation Taxes — Corporate income taxes ought to be completely eliminated. Corporate taxes, whether income, sales, or value-added, have two effects – both detrimental to the interests of the consumer and average citizen. The first is to distort the corporate treatment of liabilities. Current tax law means that interest on borrowed funds is tax exempt (treated as an operating expense, deducted from operating profits before taxes), while dividends paid to share-holders are double taxed (paid out of after-tax corporate profits, and taxed as income by the recipients). The imbalance in the treatment of capital gains means that it often “pays” a corporation and its shareholders (on a strictly tax-accounting basis) to retain earnings, and not pay dividends. Massive conglomerates are therefore intelligent options from a tax perspective. Borrow billions, and retain corporate earnings to buy up the shares of other companies.

To fix both of these problems, the profits of a corporation should be taxed as income received by the shareholders. Instead of sending a tax-slip to each shareholder just for the dividends paid out, each corporation should divide the entire corporate taxable income by shareholder, and let each shareholder report as income their portion of the earnings-per-share. This would remove the double-taxation penalty for share ownership, and remove the incentive for corporations to retain earnings to buy up the stocks of other companies.

Corporate income would naturally include the appropriate share of the earnings-per-share of any stock held by that corporation. This would remove any tax-based incentive for vertical or horizontal amalgamation of companies.

Eliminating corporate taxes in this way would have some significant advantages over both a corporate profit tax, and a sales or value-added tax. Eliminating corporate taxes would –

- Vastly simplify the corporate accounting structure by eliminating all of the special definitions of taxable income, allowable expenses, special deductions, and so forth and so on – all of the things that keep armies of tax accountants and tax lawyers (not to mention lobbyists pursuing special privileges) employed. Tax accounting as a separate set of books would disappear. The operational definition of net income would do for tax-slip reporting. This approach offers little opportunity for special interpretations of tax-specific rules or the creation of legal loop-holes that currently let many large corporations pay no corporate income taxes at all.

- Equalize the tax treatment of corporate financing. The current structure penalizes public ownership instruments (various forms of shares) in favour of debt instruments (corporate bonds and bank loans). Under current tax laws, it can make corporate economic sense to borrow money from the bank to buy back the company’s outstanding shares. When financing a new investment, it can make more sense to borrow than to find additional investors. When looking around for a place to invest retained earnings, it can frequently make sense to purchase another company’s outstanding shares (a merger or a take-over). Even if there are no other economic advantages to be had other than the shift of corporate outflows from after tax dividends to tax deductible interest on debt or capital gains.

- Reduce the operational costs for the smaller enterprises that are the source for most new job creation. It is well known that the smallest 10% of enterprises are responsible for the majority of all new-job creation, and all new wealth creation – the very companies for whom the operational overheads of tax accounting are proportionally the greatest. The General Motors and Exxons of the world may be great manufacturing enterprises that are very necessary but they are not very creative and are they not very efficient wealth creators. It is the back-yard entrepreneur who will spawn the next MicroSoft, Apple, Hewlett-Packard or IMAX. Small start-up enterprises almost always benefit most from an initial helping hand in overcoming the advantages of an entrenched competition. Reducing the accounting burden for these small low-revenue enterprises would therefore help reduce unemployment, foster the growth of entrepreneurial spirit, and tend to increase competition in any market.

- Eliminate the regressive impact of a sales or value-added tax. Most of the enterprises currently employed in the delivery of basic essentials to the bottom 20% (based on family income) of the population are relatively small ones. Food, clothing, shelter, medical care, essential transportation. In that list, the largest corporations would be represented by large food chains, clothing manufacturers, drug companies, and automobile manufacturers. But in between these giants and the consumer are a plethora of much smaller transportation and retail enterprises. By shifting the tax burden away from the final consumption and onto the larger corporate enterprises, the impact on the cost of essentials will be significantly less than it would be for a sales tax or value-added tax.

Capital Gains — A “capital gain” is the difference between the (adjusted) purchase cost of an asset, and the net proceeds of the sale of that asset. For the purposes of calculating the corporations taxable income, the purchase cost of the asset should be adjusted by the inflation rate since the date of purchase – so that purchase and sale are expressed in same-year dollars. The adjusted purchase cost of a productive asset should be depreciated by the assumed rate at which the asset wears out (following standard rules for operational accounting – not tax accounting – of depreciation). The resulting “adjusted capital gain” should then be treated as part of “Corporate Income” for the purposes of distributing income tax receipts to the shareholders.

Constraint of Trade Rules — In order to prevent a major Seller from using their market dominance to restrict the freedom of the Buyer to conduct their business affairs as they choose, it should be declared illegal, null and void any contract clause, in any (real or implied) contract between a Seller and a Buyer of any product or service, that constrains the freedom of the Buyer to deal with competitors of the Seller, or constrains the freedom of the Buyer to re-sell any product or service where, when, to whom, or at what price the buyer chooses; or that requires the Buyer to purchase or sell one product or service as a condition of purchasing or selling another product or service.

In order to prevent a major Buyer from using their market dominance to restrict the freedom of the Seller to conduct their business affairs as they choose, it should be declared illegal, null and void any contract clause, in any (real or implied) contract between a Seller and a Buyer of any product or service, that constrains the freedom of the Seller to deal with competitors of the Buyer, or constrains the freedom of the Seller to sell any product or service where, when, to whom, or at what price the Seller chooses; or that requires the seller to purchase or sell one product or service as a condition of purchasing or selling another product or service.

In order to prevent a major Seller from establishing in practice rather than by contract the price that a Buyer may re-sell a product or service, it should be declared illegal and for any advertising purchased by one company that suggests a price for a product offered for sale by another company. Thus, it would be illegal for a manufacturer’s advertising to mention a “suggested retail price” for a product actually sold by a legally separate distributor.

Pollution Liability Reporting — Current accounting practices demand that companies report only their current year expenditures on pollution abatement and avoidance. Consequently, companies have every economic incentive to minimise their current expenditures on environmental controls (both by minimising their anti-pollution efforts and by minimising their remediation expenditures), and to delay whatever expenditures they can get away with. Reporting rules need to be changed to demand that companies carry as an accrued liability on their Balance Sheet, an estimate of future costs that are likely to be incurred for remediation of whatever pollution they may be causing. And to provide an income stream in their accounting to address this liability, in a manner similar to the way that asset depreciation is handled. This would be similar to the way that they now carry an accrued liability for the pension payments likely to be required for retired employees. This will certainly not capture all the environmental costs of pollution. But it will certainly capture some of the more easily fixable costs.

An example:- Imperial Oil is not required to account for the likely site-remediation costs that will be incurred as a consequence of hydrocarbon pollution of the soils below each of their gas stations. And Suncor Energy (that operates a major plant in the Alberta Oil Sands) is not required to account for the likely costs of site remediation after oil sands mining has ceased. Requiring corporations to provide an income stream to fund this accrued liability, would somewhat prevent corporations from just walking away from their responsibilities. As long as the corporation continues to do business, it will build up a “pollution remediation fund” pool of assets earmarked for addressing the problem.

Managing The Money Supply

At the moment, the way the banking system in the United States, Canada, Britain, and many other countries is currently configured, the control of the amount of money in circulation, the control of interest rates, and thus the control of the national economy is totally vested in a small group of appointed bureaucrats at the Federal Reserve, the Bank of Canada, the Bank of England, and so forth. These people are not elected, not directly subject to public review of their actions, and not responsive (except at their own whim) to the political will of the electorate or any elected representatives. These bureaucrats have the legally authorized power to frustrate, circumvent, and nullify any economic aims and actions of the elected Legislature.

Money and Banking are considered “complex and esoteric” subjects by both politicians and the press. Explaining and discussing issues in this field is not suitable for “10 second sound bites”. As a result, our political representatives and members of the press avoid discussing them, avoid learning about them, and avoid educating the public on their significance to our daily lives. If the Central Bank should choose to initiate a recession by raising interest rates, or initiate inflation by expanding the money supply, there is little public discussion about alternatives or consequences. There might be a lot of public noise about who suffers, but no substantive public discussion of the alternatives.

Even though the politicians in the relevant legislatures have the authority necessary to over-see the activities of the managers of the Central Bank, they are loath to do so. The politicians enjoy the political rewards of authorizing the spending of monies. They do not choose to accept the responsibility for the economic consequences of their fiscal policies. If they were to start exercising their authority to oversee what their Central Bank is actually doing, they would have to accept the political responsibility for the Central Bank’s actions – whether it be economic growth or recession, unemployment, higher interest rates, or inflation. It is politically expedient to have an “independent” Central Bank to blame.

Some Elementary Economic Facts of Life — A universally accepted principle of economics is that the amount of money in circulation must approximately equal the amount of goods and services that are being demanded. If too much money is put into circulation, you get “demand-pull” inflation (too much money chasing too few goods). If too little money is put into circulation, you get a “demand-lag” recession (insufficient demand to sufficiently employ the labour force). Another universally accepted principle of economics is that the rate of new capital investment in the economy varies inversely with the interest rate. High interest rates stifle new capital investment, even if economic demand is high – resulting in “stagflation” (demand-pull inflation concurrent with low economic growth). Low interest rates promote higher capital investment, if (a big if) there is sufficient demand to justify that investment.

What is less understood, are the political consequences of these economic alternatives. Consider inflation. Who benefits and who gets hurt? The victims of inflation are not those commonly believed. During periods of inflation, wages and prices generally keep pace — thanks to “cost of living indexing”. There may be some lag, but by and large, wages and prices remain relatively stable in real terms (after inflation is factored out). Most pensions and other forms of government assistance to the poor are also indexed to the cost of living, so they too do not suffer. The people who suffer, are those with financial assets. And those with financial assets are a small minority of the population.

The beneficiaries of inflation are all those who own real assets (land and houses, for the most part), and those who are in debt. When you borrow money, you borrow in current year dollars, and repay the loan in inflated future year dollars. Inflation therefore tends to shift wealth from the wealthier (who own and lend the financial assets) to the poorer (who borrow and spend). Manufacturing too, frequently benefits from inflation – and that includes the manufacturing workers. During periods of inflation, the currency is devaluing against real assets. This generally translates into a devaluation of the currency against other currencies. Which means that a nation’s exports become cheaper and more saleable to foreigners. The victims of inflation, therefore, are the owners of financial assets and the lenders of money. They are numerically the minority, but the political influence of their wealth is significant.

The way to “correct” inflation, and restore monetary stability, is to reduce the aggregate levels of demand. There are a number of ways of doing this. Most of the levers are under the control of the Legislatures through their fiscal policies and credit management laws. The Central Bank has control over only one – interest rates. By raising interest rates, the cost of borrowing goes up and the amount of borrowed money goes down. Most of the economy depends on borrowed money to smooth its functioning – very little is exchanged on a “Cash on Delivery” basis. Many sectors of the economy are very sensitive to the costs of borrowed money. Housing starts and car purchases, as highly visible examples, will decline dramatically as interest rates go up. The effect ripples through the economy, slowing things down. Manufacturers produce less, and lay off people. Businesses can’t sell enough to cover their debts, and go out of business. Higher interest rates also generally attract foreign capital into the nation’s currency, biding up the exchange rate. As a consequence, the export prices of the nation’s exports go up, export demand falls. Manufacturers produce less, and lay off workers. Unemployment rises. Demand falls. Excess supplies of manufacturing capacity, labour, and commodities results in downward pressures on prices. Inflation is stopped.

Who benefits and who gets hurt from rising interest rates? Anyone who owes money gets hurt as the costs of borrowing goes up. Anyone who depends on borrowed money gets hurt – and most businesses fund their operations with short-term borrowing. Anyone who lends money benefits as the rewards of lending go up. Owners of real assets (land and houses, mostly) get hurt as the prices fall to reflect the rising costs of mortgages and the falling prices of commodities. Owners of financial assets benefit as the return on investment goes up. High interest rates therefore tend to shift wealth from the poorer (who borrow) to the wealthier (who lend).

None of these trade-offs are discussed by either politicians or the press. The public is largely ignorant of the alternatives and consequences. The politicians have chosen to abdicate their responsibility for making these kinds of trade-offs. They have delegated responsibility for managing the economy to the Central Bank. And the political constituency of the Central Bank, the people with whom they talk and to whom they listen, are the people who own and lend money.

How Banks Work — Suppose you come along, and deposit $10,000 of cash in my bank. Now it’s a small bank in a small town (and you are just one of many depositors), so I can draw upon the experience of 300 years of banking experience to know that it is not likely that you or any combination of my depositors will walk in and require that $10,000 in cash. I can lend out that $10,000 to other people, and earn interest on the loans. I can get away with this, because most financial transactions that will be done with the borrowed money, will not be done using cash, but will be done using checks (or other electronic forms of money). The people to whom I lend that $10,000 will take only a small portion of their borrowed money in cash. I will only need enough cash on hand to provide the needs of those who want to hold on to some cash. And experience shows that this portion will be small, and the period that people hold on to cash is relatively short. Pretty soon, one of the other people in town will come in to deposit that cash because they have received it in payment for some sale.

The early “bankers” of the 1600’s were actually Goldsmiths. And the “cash” they were dealing with was gold. The banking function was discovered when they began to print “gold receipts” as receipts for the gold bullion that they kept in their safes for their depositors. They quickly learned that they could print “gold receipts” for more gold than they actually had on deposit. They discovered that few people actually wanted to carry around their bullion. It was much more convenient for people to carry and exchange these “gold receipts”. Thus began the “fractional reserve” method of banking.

What it means today, is that my bank can lend out much more than just the $10,000 that you deposited. As long as I retain in my safe sufficient cash to satisfy any of my depositors who might come in and ask for some cash, there is no practical limit on the dollar volume of new loans I can create. As a banker, I can create new money out of thin air. Since the loans earn interest, and the deposit pays little or none, I have a nice little money-making machine. There are some risks, or course. Borrowers can default on their loans. And depositors can come in and demand more cash than I have on hand at the moment. But the niceties of modern day banking legislation easily minimizes these risks. (In fact, the banking business in Canada is so lucrative that the major Canadian Banks have collaborated to “persuade” the Federal Government to enact such stiff entry requirements, that it is almost impossible for a new bank to start up in competition.)

In order to put some constraints on the potential for excesses, the banking laws in some countries stipulate that I must maintain “reserves” (ie. “cash on hand”) of a minimum of 10% (in the US. Canada has no minimum reserve requirement) of demand and checking deposits. Which means that, in the US, based on your $10,000 deposit, I could write loans for (and of course earn interest on) $100,000. In Canada, I could write loans for any amount I thought advantageous.

In actual operational fact, the presence or absence of reserves, or reserve requirements has little or no effect on the commercial banks’ operations. When a customer comes in and wants a loan, the Bank simply logs the loan on their books as an asset, and creates the equivalent demand deposit as a liability. The Bank’s books stay balanced, and the “money” simply appears out of thin air as an accounting entry. In actual practice, the commercial banks create as much money as necessary to fund the loans they make. Money creation depends on the demand for loans, not on any deposits. Should they need it, they can always borrow additional reserves and cash from their friendly Central Bank. In fact, the only limit there is on the amount of loans that a commercial bank can write, is the willingness of customers to take out loans. And since the interest that the commercial banks charge on the loans they write is greater than the interest they pay on the deposits they hold, being a commercial bank is a license to print money. It is therefore no small wonder why the banking lobby has made such efforts to restrict the number of new entrants into the industry.

To make things even easier, the banking laws in most countries permit many financial instruments besides cash currency or government bonds to be classified in the category “reserves”. In many countries, just about any commercial debt instrument will qualify. As will, of course, Canadian or US Treasury bills and bonds, and bank deposits held at the Central Bank. Commercial banks can, therefore, not only earn interest on the outstanding loans they issue, they can also earn interest on the “reserves” they happen to retain.

Combine the economic facts of life that make it clear that owners of assets and lenders of money are hurt by inflation but benefit from high interest rates, with the working principles of banking operations, and it becomes obvious that commercial bankers are the most vociferous proponents of –

- “fractional reserve” banking operations;

- minimal regulatory controls on credit;

- stable (non-inflationary) money;

- high interest rates; and

- non-inflationary fiscal policies (balanced budgets).

These policies result in an economically regressive transfer of wealth from the poorer to the richer, and an allocation of economic pain and dislocation disproportionately on those least able to bear it. So it is only natural that the banking community strongly opposes any modification of the current banking regulations, any oversight of the Central Bank, or any reduction in the secrecy and “mysticism” with which the Central Bank carries out its functions.

Creation of Money — When the Central Bank wants to increase the money supply (or lower interest rates, which is effectively the same thing since you can’t do one without the other), it purchases “stuff” on the open market. To pay for what it buys, it arranges an electronic funds transfer — which effectively means moves some accounting entry from one account to another. The money gets deposited into the account held by the Central Bank for the commercial bank who sold the “stuff”. The banking system makes use of the additional reserves they now have by lending out (ie. creating) money to commercial customers.

(I should point out that this does not always happen. After the financial crisis of 2008, the U.S. Federal Reserve drastically expanded the amount of bank reserves by purchasing billions of dollars of “mortgage backed securities” on the open market. This did not have the expected results, however, because most of the commercial banks sat on the additional reserve balances. This was because the Federal Reserve was paying interest on those accounts, and the demand for loans dried up as the economy went into recession.)

Where does the Central Bank get the money it pays out to buy that “stuff”? It creates it out of thin air. There is nothing to back it up. Most countries’ currency is no longer based on gold, or on any commodity standard. Most countries’ money is what is called “fiat currency”. It has only the value that the Central Bank declares by “fiat”. There is no theoretical limit to the amount of money that the Central Bank can create in this way. The only practical limit is the consequence to the economy of issuing too much money – inflation. The accounting books balance at the end of the day, because the purchased “stuff” is held on the accounts as an “Asset” to correspond to the “Liability” created by the outstanding payment. The “control” (such as it is) on excesses of the Central Bank in the creation of money, is that the Central Bank has no direct incentive to buy “stuff”. The Central Bank itself is not a profit making enterprise. Any income earned on the “stuff” it buys is returned as income to the Federal Government.

See A Brief Introduction to Modern Monetary Theory.

Or Wray, L. Randall; “Understanding Modern Money: How a Sovereign Currency Works” in Ganssmann, Heiner (Ed.); New Approaches to Monetary Theory: Interdisciplinary Perspectives, Routledge, New York, New York, 2011. ISBN 978-0-203-83012-3. Online version available at URL=http://www.levyinstitute.org/pubs/wray_understanding_modern.pdf.

Two economic factors govern how much money the economy requires (without having too much or too little). One is the “velocity of money”. This is a technical term indicating how rapidly money changes hands over time. In 1987 (the last statistic for which I have data), the velocity was approximately 6. This means that a Gross Domestic Product of $100 billion will require about $16.7 billion in money. The velocity of money changes over time, as people change their individual attitude about maintaining their own “cash on hand”. The other factor is the growth of the Gross Domestic Product. As it grows, the economy will need more money. As a consequence of these factors, the Central Bank very rarely has to actually decrease the money supply. Instead, it merely has to regulate the rate at which it permits the supply to grow.

But if it does choose to contract the money supply, it does so by the reverse of its normal process. It sells “stuff” on the open market. When it receives payment for what it has sold, it decreases the account against which it normally issues payments, and simultaneously decreases the asset balance. If necessary (it has never been) it has the authority to borrow Government Treasury Bills from the Finance Department, in order to sell them on the open market. The “stuff” that the Central Bank trades in is any interest-bearing debt instrument. As the debt instrument is paid off by the issuer, the monies received by the Central Bank decrease the account against which the payments were drawn, and simultaneously decrease the asset balance.

Now the most interesting thing about how Central Banks work in an environment of “fiat money” and a “fractional reserve” banking system, is that the Central Bank is not the main creator of money. The Central Bank only creates “reserve money”. It is the commercial banks in the economy who create the “real money” by creating loans to customers and creating bank balances that these customers spend into the economy. In Canada, with a 10% reserve requirement, the commercial banks create ten times the amount of money than the Bank of Canada.

Which is a foolish way to run a government. From the point of view of the Federal Government, it would make far more sense for the Federal Government to spend all of this created money into circulation. In 2020, the U.S. Treasury Department did this very thing, buy issuing “COVID Relief” cheques to its citizens. But the Banking lobby would not want this to become standard practice. It would take away their profits.

Recommended Policy Actions — The history of the Central Banks of most modern countries demonstrates that the bankers are the ones who are running the show, will run it for the benefit of the banking industry, and not the electorate to whom they are not responsible. Whenever there has been a threat of a run on any bank, the appropriate Central Bank has created sufficient liquidity in the money market to protect the banks – regardless of the economic consequences. The latest example of this was the $700+ Billion bail-out of the banking industry when Lehman Brothers collapsed. Whenever inflation has become a significant banking concern, the Central Banks have raised interest rates and initiated recessions – regardless of the consequences to the population. The first and most important banking reform required is, therefore, to restore political control over the economy. To that end, the Central Bank must be made a subsidiary department of the respective Federal Department of Finance (ie. The US Treasury Department). The Minister or Secretary of Finance/Treasury must become also the Chief Governor of the Central Bank. The political processes must no longer be permitted to circumvent their responsibility for the economic prosperity of the nation.

The creation of money should be taken from the commercial banks and vested in the Department of Finance/Treasury. The Federal Government should spend the money into existence. Currently, to spend money it doesn’t have, the federal government sells a Government Treasury Bond and uses the money thus obtained from the open market to fund its operations. The Central Bank then creates money out of thin air to buy it back from the open market, preventing government spending from overly flooding the economy with cash. Eliminate the middleman. Allow the Finance/Treasury Department to create the money out of thin air.

See the essay on Banking Reform — The Chicago Plan

Some Additional Banking Regulations — Far too much of the banking system’s portfolio of outstanding loans are to Third World governments, commodity and real estate speculators, and buyers of non-productive financial instruments. Bankers have been seduced by the higher interest payments that these risky and non-productive ventures are willing to pay. The whole idea of creating new money, however, is to foster the creation of new wealth in the form of increased output. The banks need to redirect their loan portfolios away from non-productive borrowers and towards capital investment projects and direct consumption activities (if the demand is there, some entrepreneur will create the supply). To that end, a series of new Banking system regulations are required:

- Banks must be prohibited from loaning monies to any foreign government. (This would not restrict inter-government loans. But such loans would be made for political reasons, not for profit.) Governments, by their very nature, are not profit making – or wealth making – enterprises, so it is economically illogical for a private enterprise to loan funds to a government other than your own. Loans to your own government are different, since you presumably benefit from the result.

- Buying stocks and bonds (and other financial instruments and derivatives) on margin should be minimised by requiring all brokers and other intermediary organisations to require full payment within a maximum of 10 (or less) business days of any purchase. Gamblers would still be able to borrow money from lending institutions in order to purchase securities. But “margin” accounts, in their current format, would be prohibited.

- Organisations with an income interest in the trading activity (such as brokers and others who earn commissions on the trade) would be prohibited from lending the money being used to make the purchases. This would eliminate a conflict of interest situation that would otherwise tend towards the relatively uncontrolled margin activity that currently exists.

Currency Speculation Controls — There is no part of the financial economy in greater need of being slowed down than the currency traders. It is estimated that currency transactions now exceed $1 trillion a day. There is no productive justification for that volume. It exceeds the combined annual Gross Domestic Products of many countries. And it exceeds by several times the combined value of international trade. The vast majority of it is pure and simple speculation. As numerous writers have pointed out (one example is George Soros), the volume is large enough, and the speed of movement fast enough, that the speculators can easily overwhelm even the largest government. It is another case where economic power over a nation is vested in a small band of unelected private investors who are responsive only to their own interests and whims, and not to any electorate or elected representatives. Their power needs to be curtailed.

A “Currency Conversion Tax” should be enacted. This would be set up on a progressive scale, landing more heavily on the larger transactions than on the smaller ones, and exempting small ones below some cut-off. It would be collected by all financial institutions on the sale side of any currency trade. It has been suggested by a few authors that a rate of 0.1% of the value of any sale over $10 million would be sufficient to stifle the tide of international currency speculation. But this flat rate number would have to be modified slightly to implement a progressive taxation of the larger trades at a higher rate. It might also have to be increased if the initial implementation does not succeed in damping the international sloshing of free capital.

Labour Monopoly Elimination

In all of the modern industrial “western” world, all corporate and government monopolies and near monopolies are tightly regulated by the government. They are closely watched, and their prices and profits are controlled. Any price increases require government approval, and generally require thorough economic justification. There is one notable exception, however. All major labour unions exert monopolistic control over the labour market of their respective sectors. Yet their monopolistic pricing power is totally uncontrolled by any regulators.

When costs grow faster than productivity, the result is “cost-push” inflation. For most manufacturing enterprises, and all service enterprises, labour costs form the large majority of production costs. So when labour costs grow faster than general productivity, the result is “cost-push” inflation. Examining the US statistics since 1949 shows that although the average manufacturing wage has grown dramatically in nominal terms, when adjusted for inflation it has grown no faster than, and in lock-step with, the growth in average manufacturing labour productivity.

Therefore, all legislation granting labour unions special freedoms from anti-trust provisions, and freedom from anti-coercion laws should be repealed. A “Right to Work” law will make it illegal to require union membership as a qualification of employment, or to force new employees to join a union once employed. All licensing requirements as a condition of employment or employability should be revoked. It should be illegal to require the individual to obtain a license, or join a group, to be able to practice any line of work.

For a longer arguement in favour of this idea, see https://www.hoover.org/research/occupational-licensing-bad-idea.

Or, see https://ipa.org.au/publications-ipa/submissions/the-case-for-abolishing-occupational-licensing.

For a detailed discussion of Occupational Licensing, see https://obamawhitehouse.archives.gov/sites/default/files/docs/licensing_report_final_nonembargo.pdf

Note that this will not prevent professional organizations from offering “certificates of competency” to suitably qualified persons. It will just prevent professional organizations from restricting the labour supply by requiring such paper-work before an individual can practice any particular profession or trade. Note also that this is in keeping with the general principle of the state not interfering with voluntary trades, and the state’s duty to prevent coercion. Laws prohibiting fraud can be used to prevent (or penalize) “false advertising” — selling services without sufficient competence. And it will also permit lesser-skilled trades-people to practice as long as they announce their lesser skills. For example, there is nothing inherently wrong with a neighbourhood “healer” offering medical services and advice to willing consumers, as long as there is no false advertising about the training and skill of the “healer”. This change will also drastically reduce the costs of medical care, legal services, and even plumbing services.

Given the enactment of the Universal Basic Income, all minimum wage legislation can be repealed. Contrary to much political advertising, minimum wage laws do not help those they are supposed to. It is argued that a minimum wage law is required so that those at the low end of the wage scale can earn enough to keep body and soul together. But what the minimum wage laws actually do is make unemployable those with insufficient skills to be worth more than the minimum wage. An employer who might hire two people to sweep out the store room at $5.00 per hour, will hire no one if the minimum wage is set at $15.00 per hour. Two people just became unemployed. And with their low level of skills, unemployable!

The combination of eliminating the minimum wage laws and enacting the Universal Basic Income legislation, will allow even the least skilled, least qualified of the poor to find productive employment, gain the aid of society, and keep their sense of self-worth and self-respect.

Benefits Portability — One of the factors that interferes with the freedom of the labour market, is the restrictive nature of company pension plans and health insurance plans. Company pension and health insurance plans should be converted to individual retirement accounts (RRSPs or 401Ks or equivalents), and individual health insurance subscriptions. The Pension Plans would be locked-in, income tax free, individual investment accounts. Monies would be deposited into these accounts at a rate commensurate with current pension plan policies. The assets in these accounts will have the currently limited opportunities for investment, so that their safety is reasonably assured. And the assets would be permitted to accumulate tax-free. Taxes would be levied on the funds at the time of withdrawal. In addition to transferring more responsibility for retirement planning to the individual, this change would remove a significant interference with labour mobility, and cleanup some outstanding problems with corporate liability accounting. It would also remove a large incentive for nefarious (both legal and illegal) activities out from under the noses of some corporate management. Health Insurance plans should be transfered to whatever public or private solutions are in place, but otherwise removed from the responsibility of the employer.

Some Miscellaneous Changes

Tort Responsibility (1) — The principle of individual responsibility for one’s own actions needs to be returned to the enforcement of law. If you are doing something that “any reasonable person” would understand you should not do, or are using a product in a way that “any reasonable person” would understand you should not, then you have no grounds for a damage suit if you experience damage as a consequence of your unreasonable actions. This needs to be stated as a principle governing Tort law. The classic example of a violation of this principle, is the burglar who trips on the (inside) stairs and breaks a leg, then sues the homeowner for damages. Or the Macdonald’s customer who orders hot coffee and then sues for injury because she spilt the coffee. The concept of “any reasonable person” is well exercised in current law, and is used to provide courts and juries with the flexibility to determine “reasonableness” on a case by case basis. What is lacking is the legal emphasis on personal responsibility. Juries must therefore be instructed to include the plaintiff when apportioning out the degrees of responsibility for any damages involved. And they must also be instructed that it is not the function of Tort Law, and the awarding of damages, to compensate people for being stupid (ignorant maybe, stupid definitely not).

Tort Responsibility (2) — Liability law in the US currently is based on the concept of “The deeper pocket pays”. This means that when a plaintiff wins a damage suit, the award is paid by the defendant most able to pay, rather than the defendant most responsible for the damage. Consequently, it is standard practice in the US, for law suits to include all parties even vaguely connected to the issues at hand, especially if they happen to be a big and wealthy one – even if the connection to the damage being claimed is highly tenuous. This needs to be changed. The practice costs consumers vast amounts of money to pay for damages that have little or nothing to do with the corporation paying the damages. It also is in contravention to the principles that responsibility must be commensurate with authority and that punishment should fit the crime. So instead, juries must be instructed to judge the degree of responsibility of each defendant found guilty of the damages involved. Any damage award to the plaintiff must then be paid by the defendants according to their relative responsibility. If any defendant is found not responsible at all for the damage involved, then that defendant’s costs must be paid out of the damage award before the remainder is paid to the plaintiff.